Credit-control and recovering debts can be complex, time-consuming, and expensive and companies of all sizes often look to outsource these processes to an external provider. Outsourced credit-control and debt collection enables a business to leverage a specialist agency’s wealth of expertise and resources. It can improve the efficiency and effectiveness of collections, reduce costs, and enable inhouse teams to focus on the areas where they can really add value.

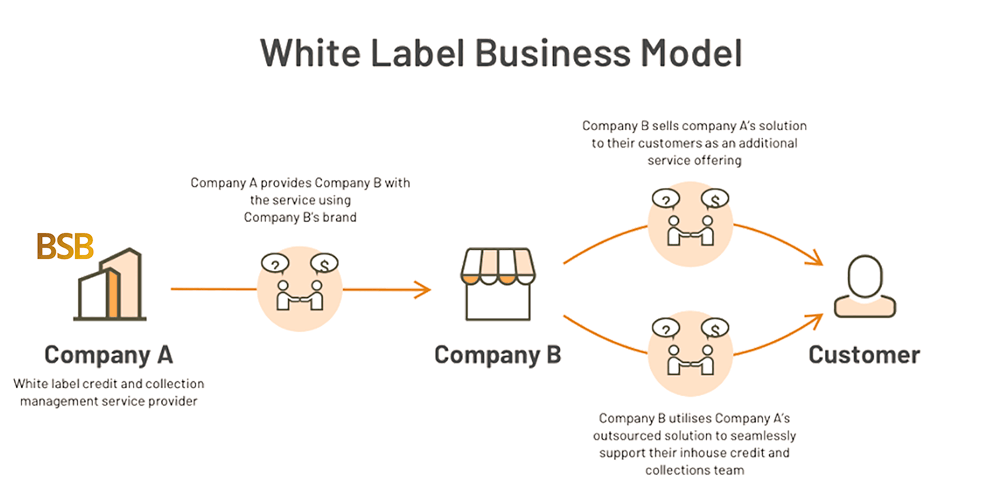

Outsourced credit-control is usually delivered as a white-labelled, first-party service. This means the agency delivers their services for a client or partner using the client’s name and brand. This gives the client’s customers the appearance of the credit-control services being carried out in-house rather than having been outsourced to an external agency as illustrated in the diagram below.

As each client and their customer relationships are unique, so should be the outsourced credit-control service delivered by the provider. The service should be highly customisable, and delivered in a pace and tone which fits the client’s customer relationships and brand – a seamless extension of their inhouse team. Outlined below are some of the key business benefits outsourced credit-control can deliver.

Access to expertise

Cash collection is an outsourced credit-control service providers primary function, and they are totally focused on ensuring the efficiency and effectiveness of their processes. They have experience across multiple verticals, in many economic conditions and of a vast array of cash collection tactics. A good, outsourced credit-control provider will apply their process knowledge to ensure you achieve your cash collection targets and deliver your customers an outstanding customer experience.

Continuity of service

An inhouse credit-control team is a finite resource which can be impacted by sickness, holidays, recruitment challenges and maternity leave. These can all have a significant effect on performance and can lead to backlogs and the potential for bad debt. A good, outsourced service will guarantee your business operational cover. Through ensuring additional staff are trained on your account, they will deliver consistent levels of service – ensuring that when your customers are open, they will be chasing payment.

Flexibility and scalability

It is not uncommon for businesses to be seasonal with ebbs and flows in demand throughout the year. This can make it challenging to maintain the correct staffing levels within an inhouse credit-control team. They can often end up either under or over-resourced and must make strategic decisions on which accounts to prioritise.

The flexibility and scalability of an outsourced credit-control provider can ensure 100% of your accounts receive effective credit-control coverage. The most common approach is to leave your priority accounts in the hands of your inhouse team – ensuring they receive the necessary attention and support to maintain on-going relationships. Whilst the scalability of the outsourced provider, can ensure all your other accounts, who might have historically only received a Dunnings email or letter, can also receive a gold standard service.

Reduced costs

The costs of running an inhouse team is more than a monthly paycheck. Recruitment, training, office overheads, HR resources and pension contributions all make the true costs of substantially higher – which is why reducing headcount is often a key focus for businesses looking to improve profitability. With an outsourced credit-control service these additional costs are someone else’s liability. Your business pays simply for the service they need when they receive it.

Improved customer satisfaction

A consistent and comprehensive credit-control service enables the swift identification and resolution of any payment disputes. This can not only increase customer satisfaction, but by removing barriers to payment and enabling your customers to continue to trade lead to increased sales.

Improved cashflow

Access to the right expertise, the right resource level, at the right time will without question optimise your cash collection – improving cash flow and the bottom-line. Ensuring prompt payment of invoices will reduce borrowing needs, increase working capital and drive growth.

Conclusion

Effective credit-control is critical to the financial health of a business. Securing prompt payment for any good or services delivered has a direct impact on an organisation’s cash flow and is vital to ensuring liquidity. Despite this many businesses fail to prioritise cash collection. A secondary back-office function, it can often be over-looked and under invested until crisis hits. And even when fully prioritised, it is challenging for inhouse teams to cost-effectively deliver a consistent credit-control service. This so often leads to an accumulation of ageing debts.

Outsourcing credit-control to a specialist agency can enable your business to cost effectively deliver a consistent level of service, optimising cash collection and ultimately the financial health of the business.

Barratt Smith Brown specialise in providing bespoke, white-labelled credit-control and debt collection services to our clients. If you would like more information regarding our services and what they could deliver for your business, please drop us an email to business@thebsbco.com or give us a call on 0116 296 1438

CEO, Barratt Smith Brown

Ashley has extensive experience working with blue-chip businesses to help them improve cash flow and deliver their working capital targets.